How to Login and start trading Crypto at Phemex

How to Login to Phemex

How to Login your Phemex account

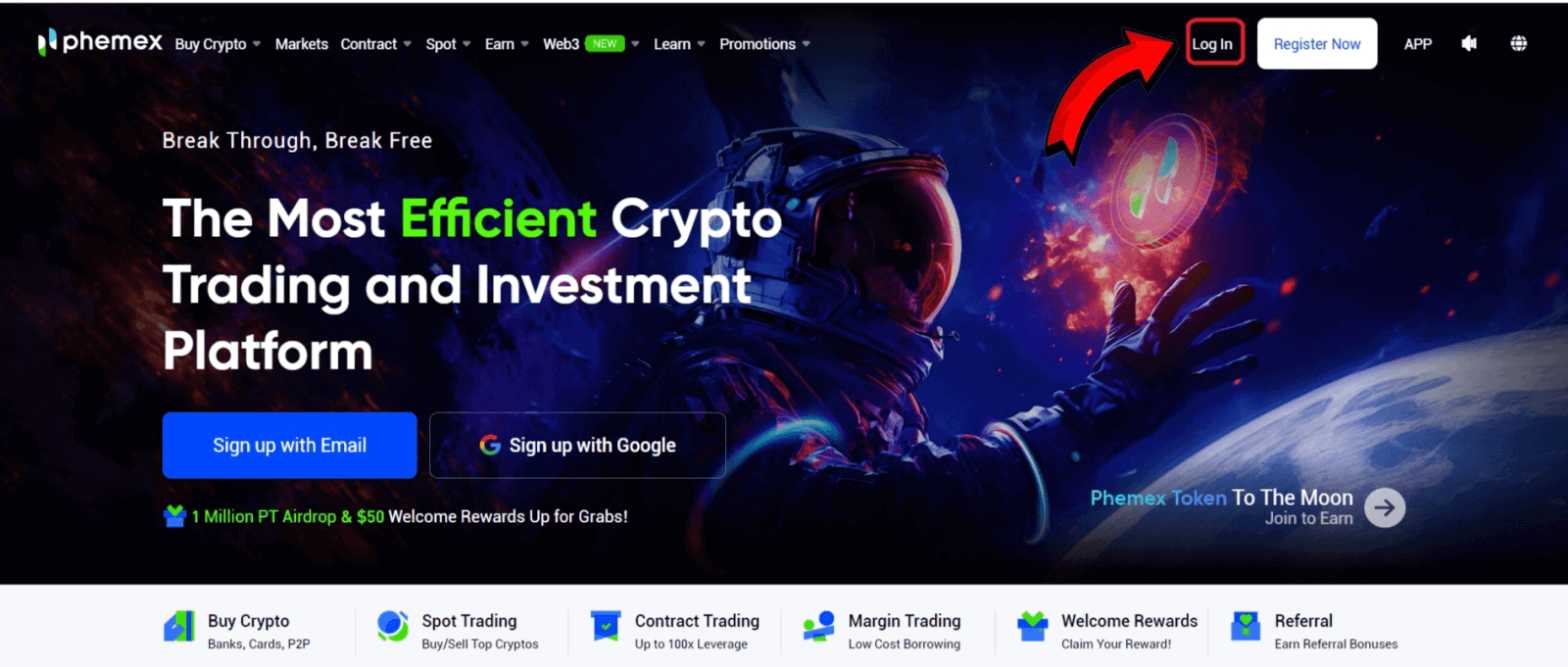

1. Click on the "Log In" button.

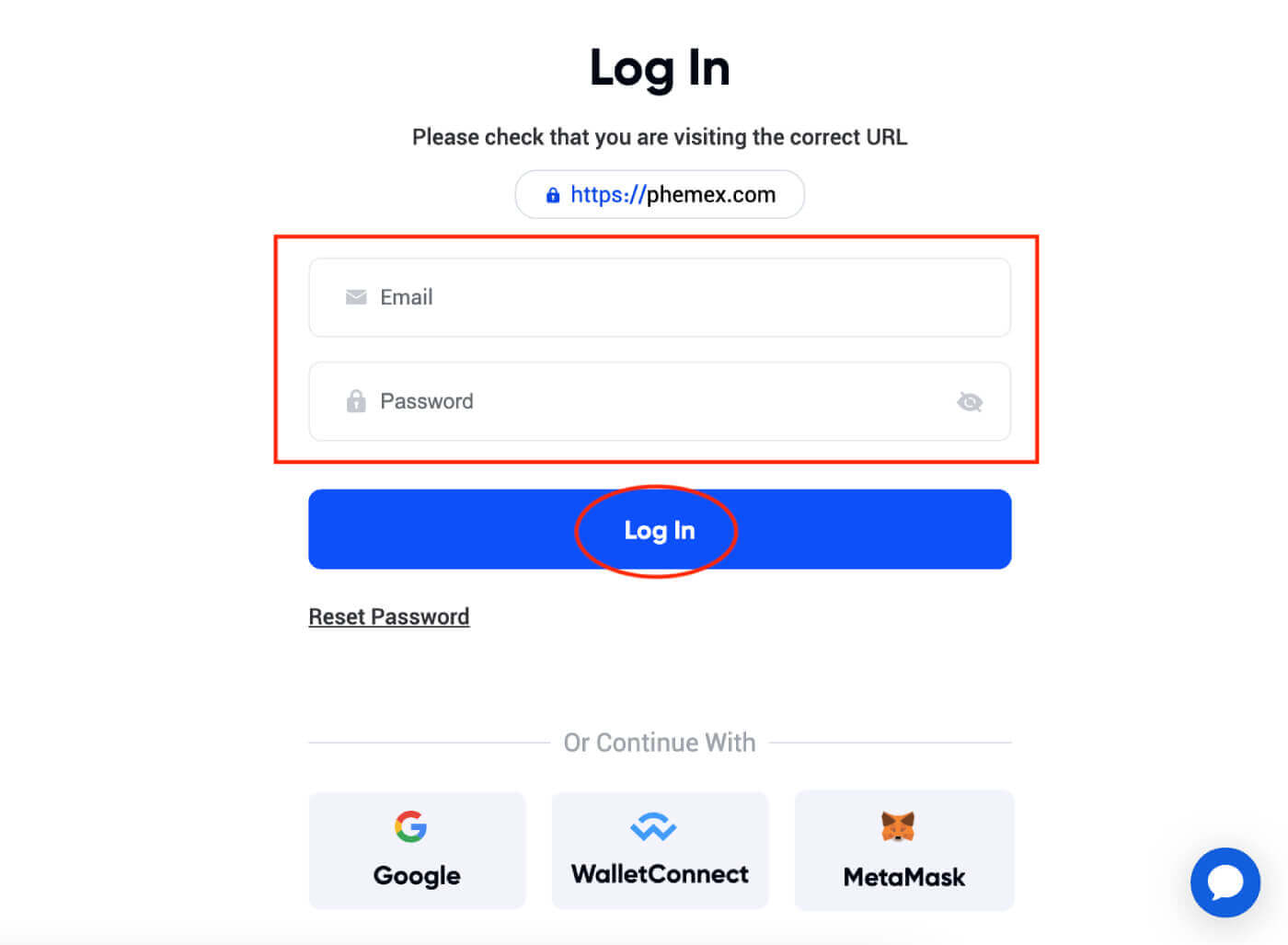

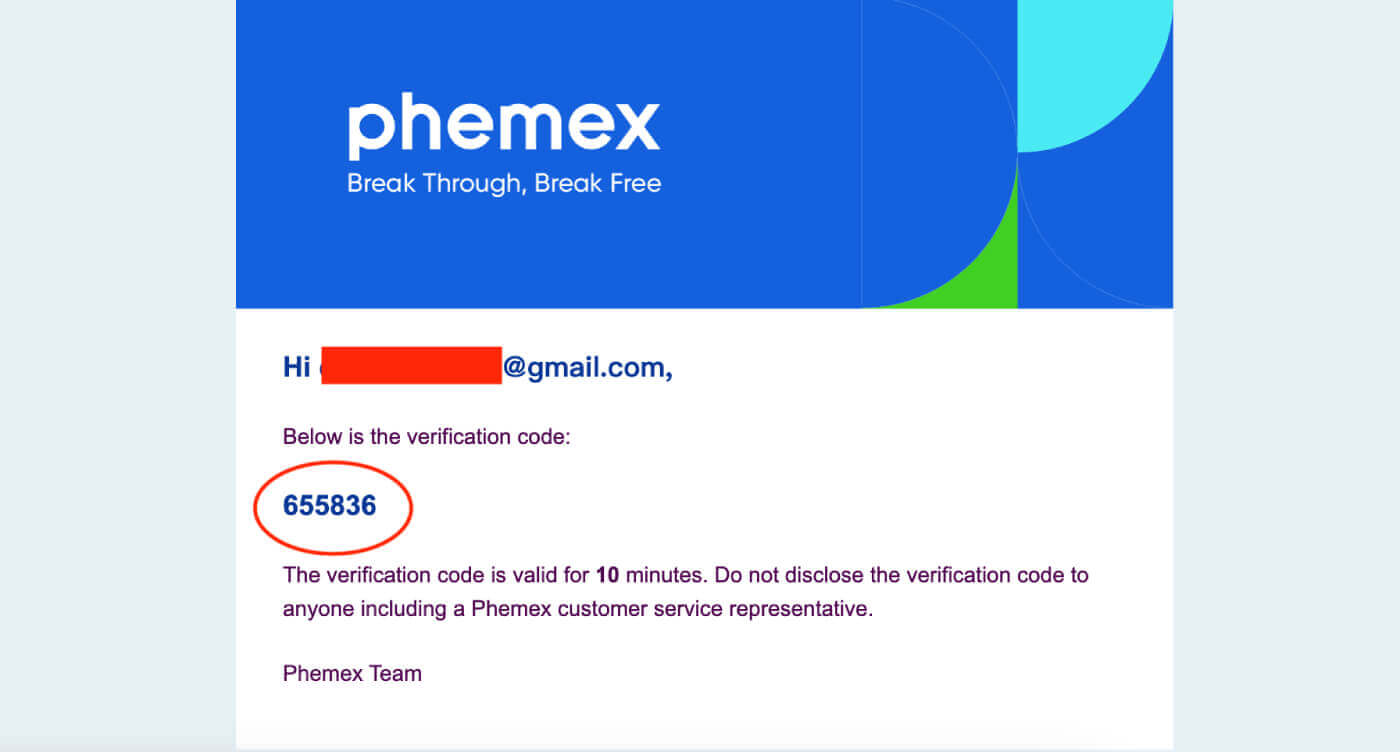

2. Enter your Email and Password. Then click "Log In". 3. Email verification will be sent to you. Check your Gmail’s box.

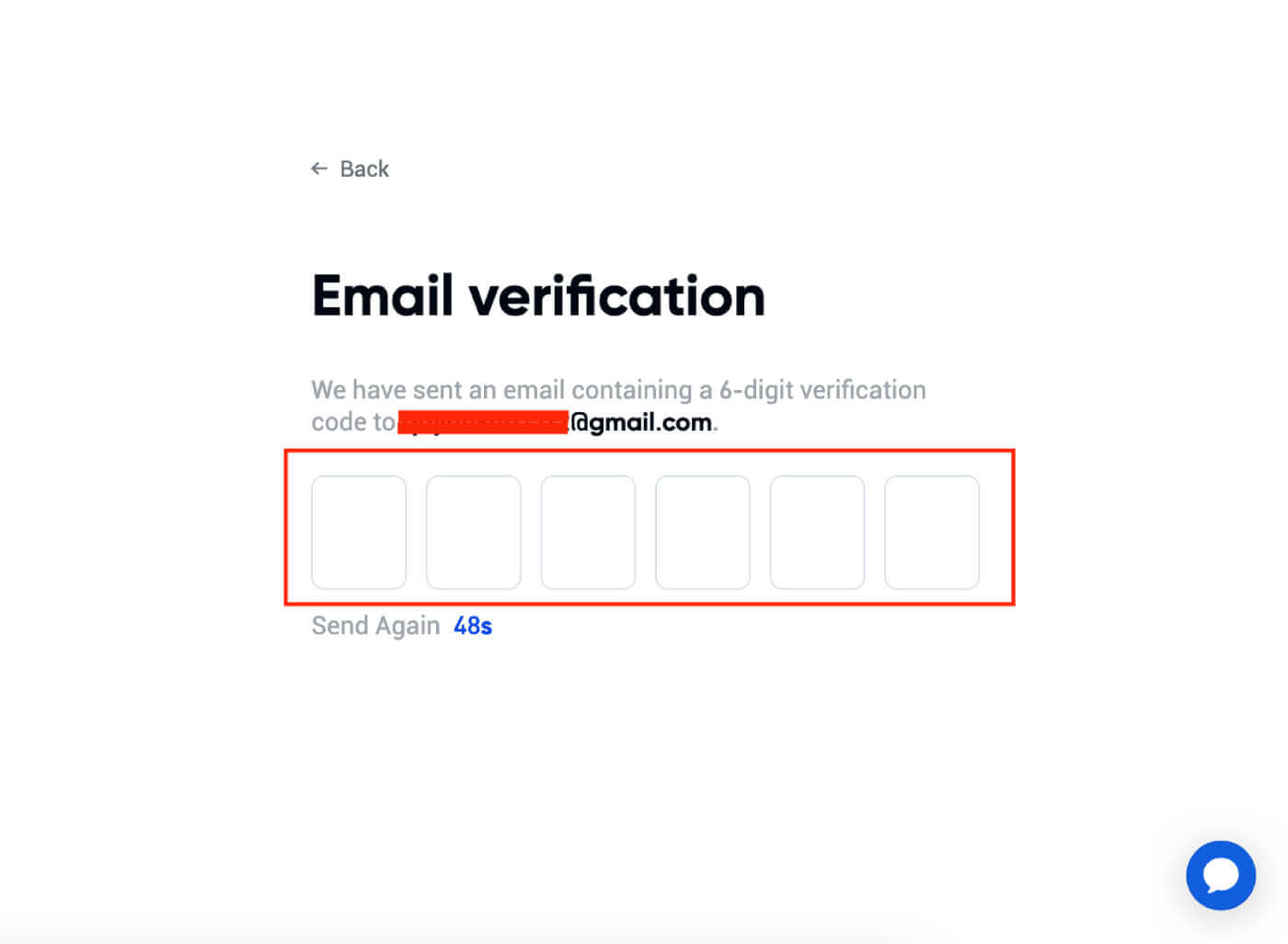

3. Email verification will be sent to you. Check your Gmail’s box. 4. Enter a 6-digit code.

4. Enter a 6-digit code.

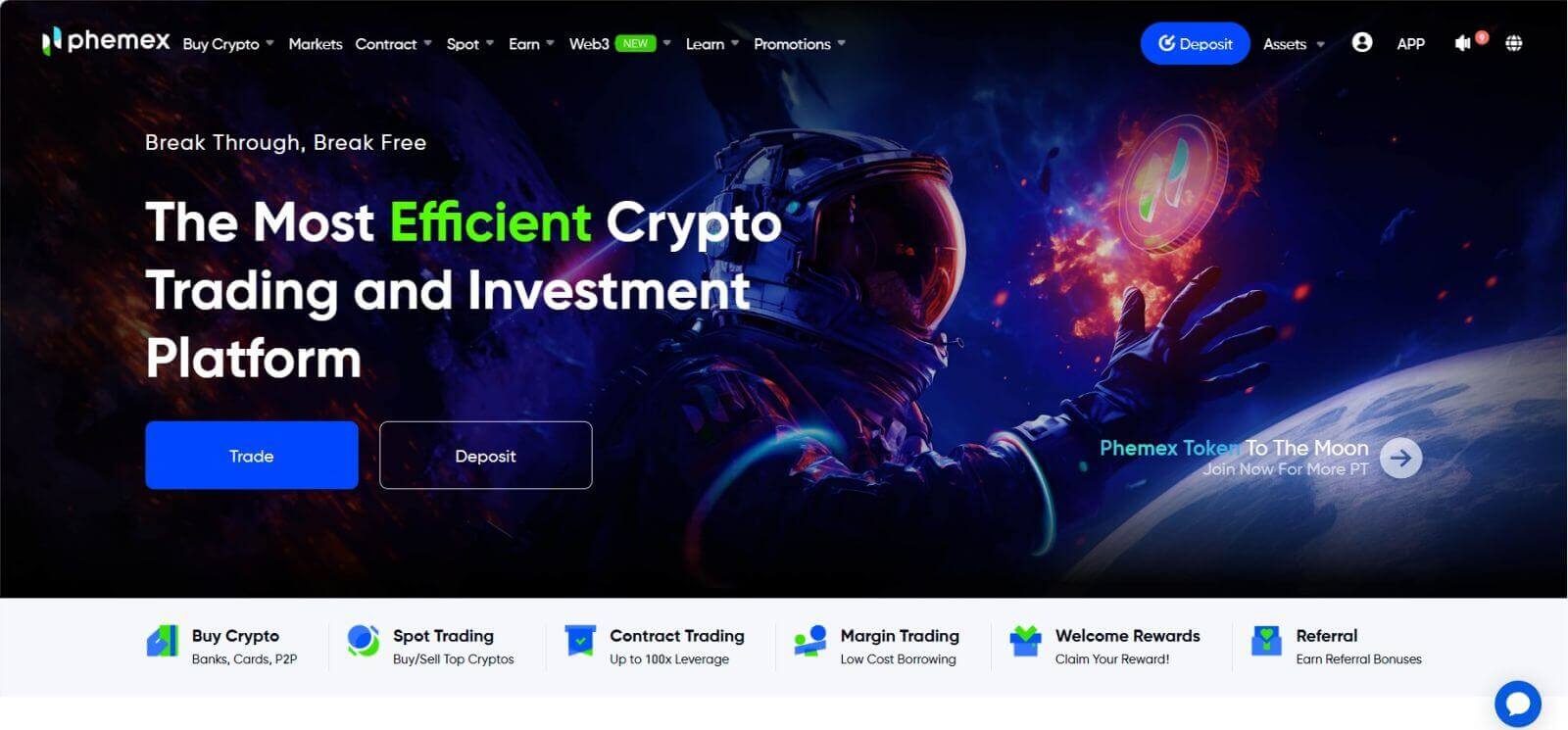

5. You can view the homepage interface and start enjoying your cryptocurrency journey right away.

How to Login on the Phemex app

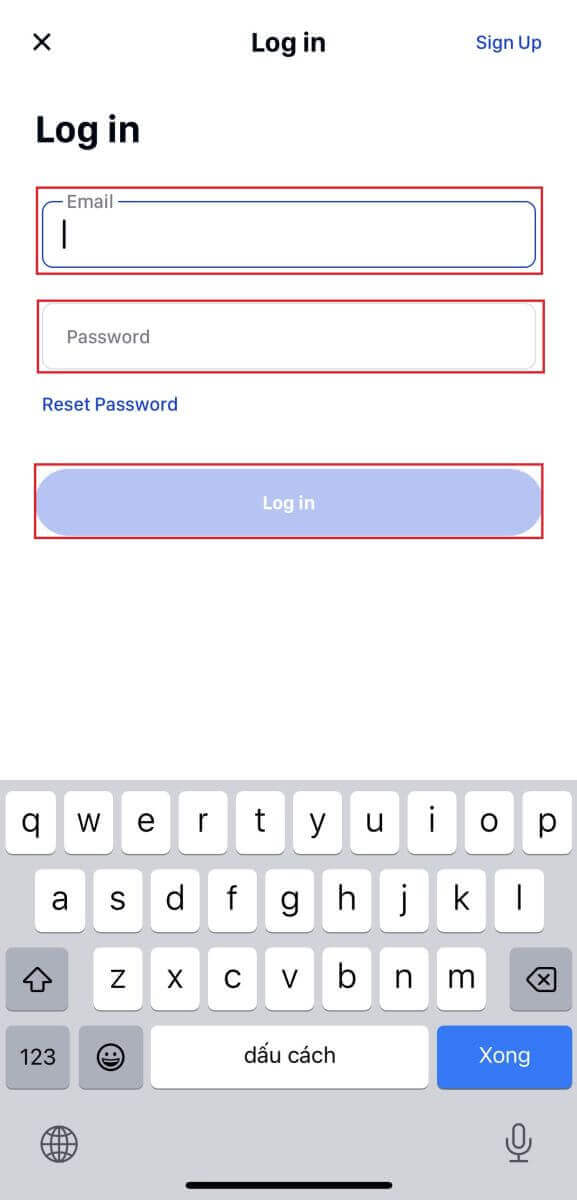

1. Visit the Phemex app and click "Log in".

2. Enter your Email and Password. Then click "Log in".

3. You can view the homepage interface and start enjoying your cryptocurrency journey right away.

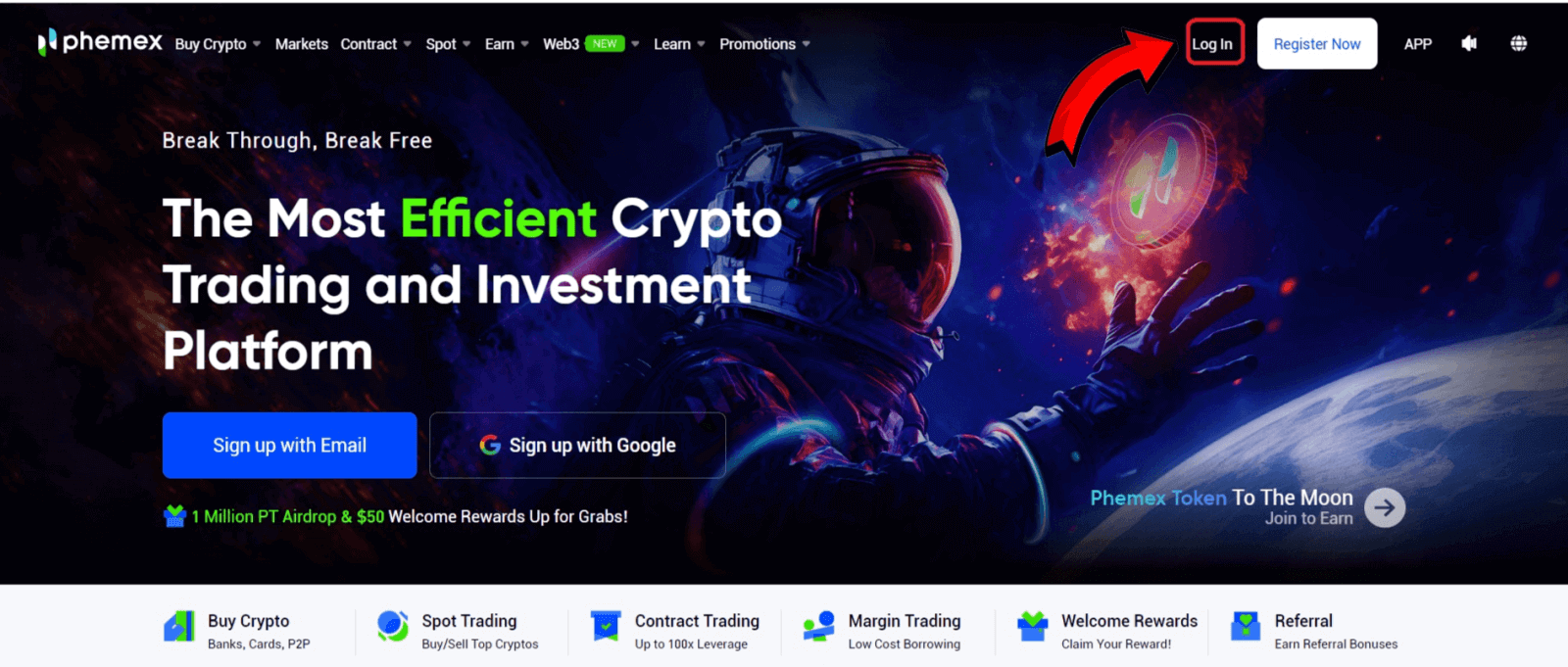

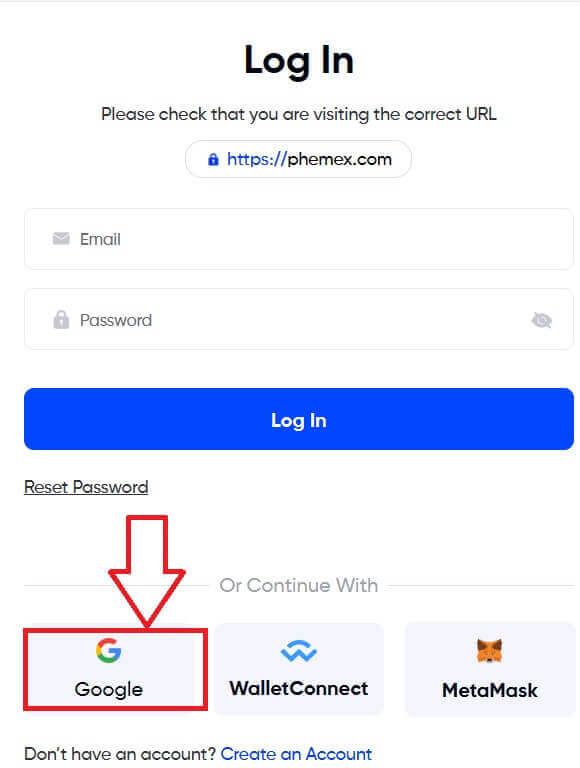

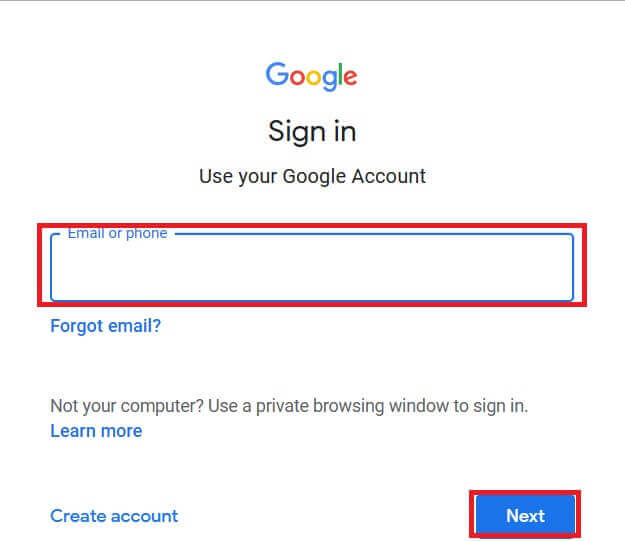

How to Login to Phemex with your Google account

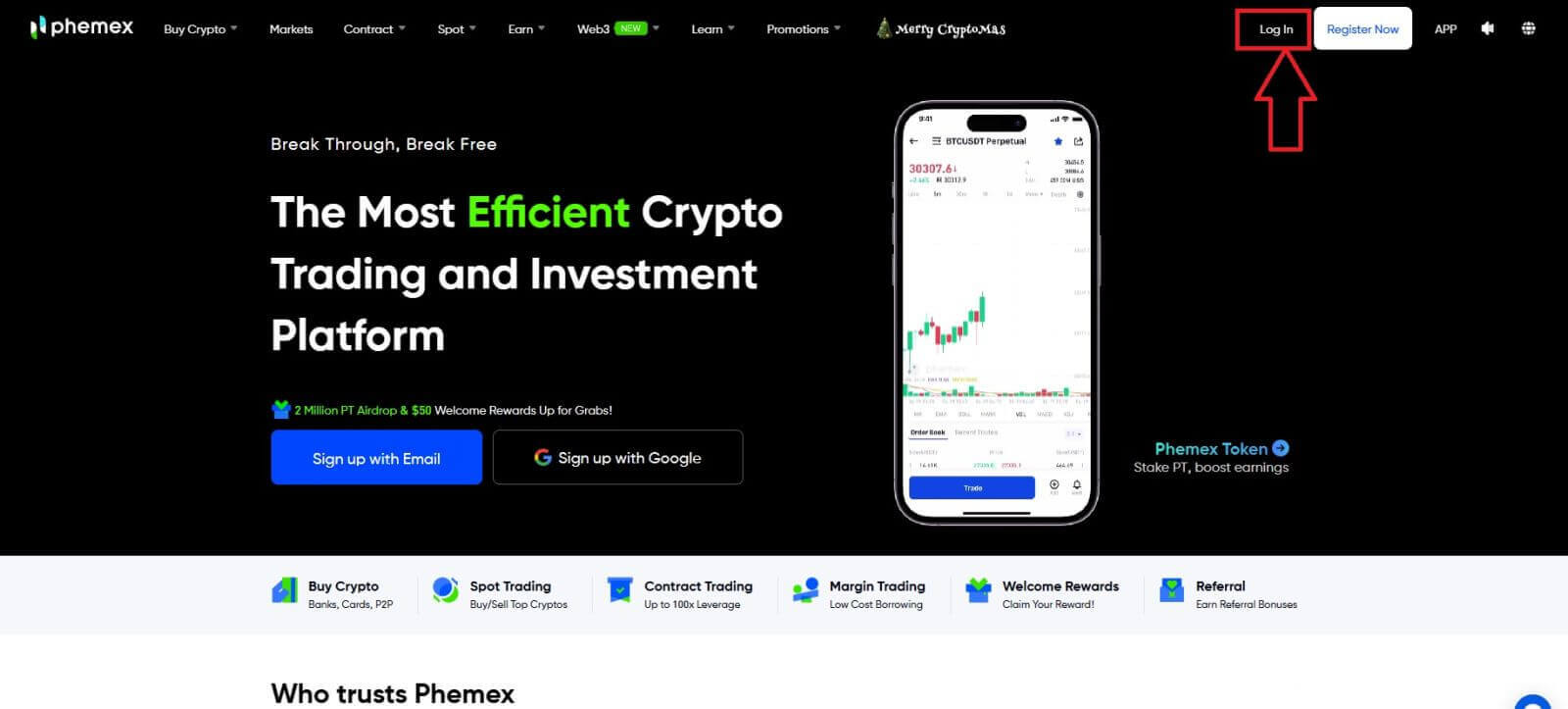

1. Click on the "Log In" button.

2. Choose the "Google" button.

3. Enter your Email or phone and click "Next".

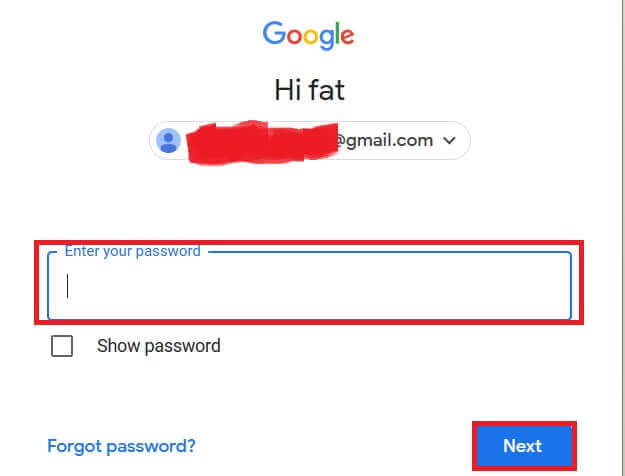

4. Then enter your password and choose "Next".

5. After all, you may see this interface and successfully log in to Phemex with your Google account.

How to connect MetaMask to Phemex

Open your web browser and navigate to Phemex Exchange to access the Phemex website.

1. On the page, click the [Log In] button in the upper right corner.

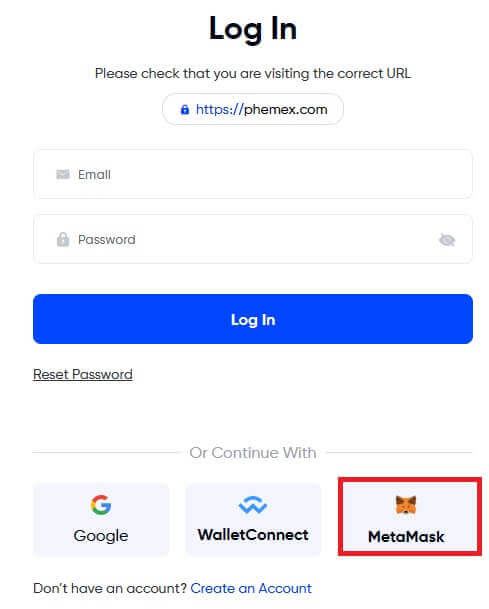

2. Choose MetaMask.

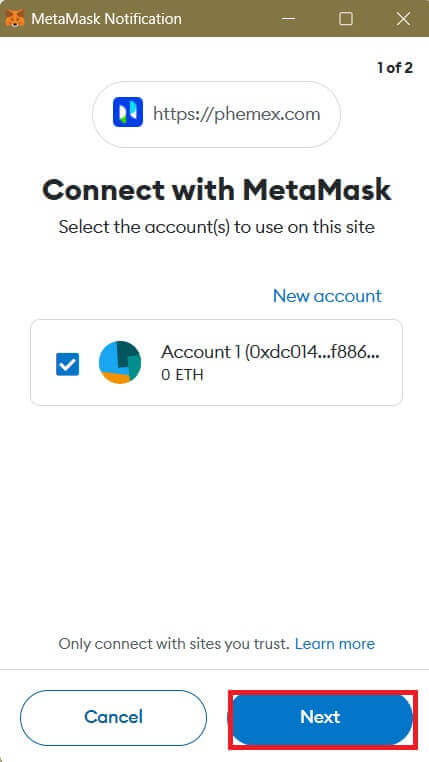

3. Click "Next" on the connecting interface that appears.

4. You’ll be prompted to link your MetaMask account to Phemex. Press "Connect" to verify.

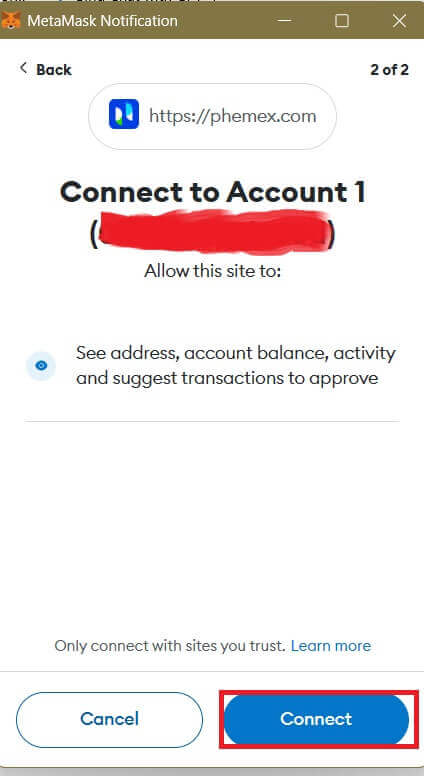

5. There will be a Signature request, and you need to confirm by clicking "Sign".

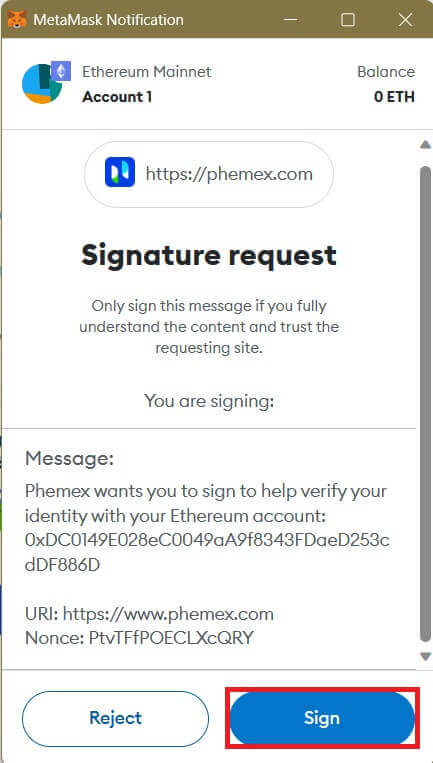

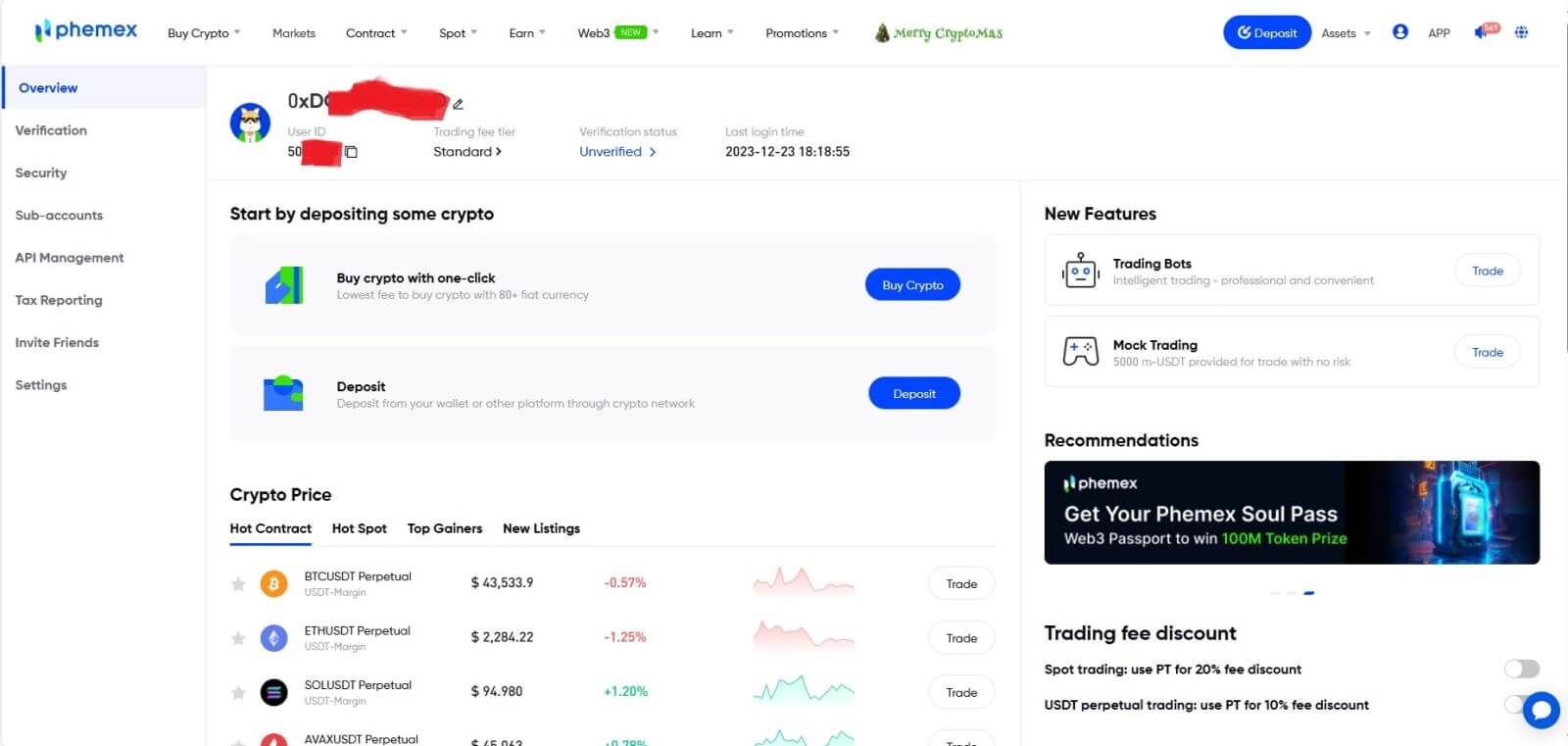

6. Following that, if you see this homepage interface, MetaMask and Phemex have successfully connected.

I forgot my password from the Phemex account

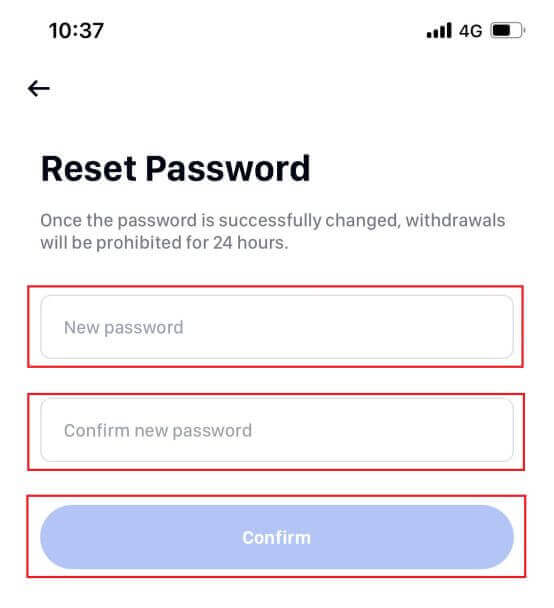

You can use the Phemex app or website to reset your account password. Please be aware that withdrawals from your account will be blocked for a full day following a password reset due to security concerns.

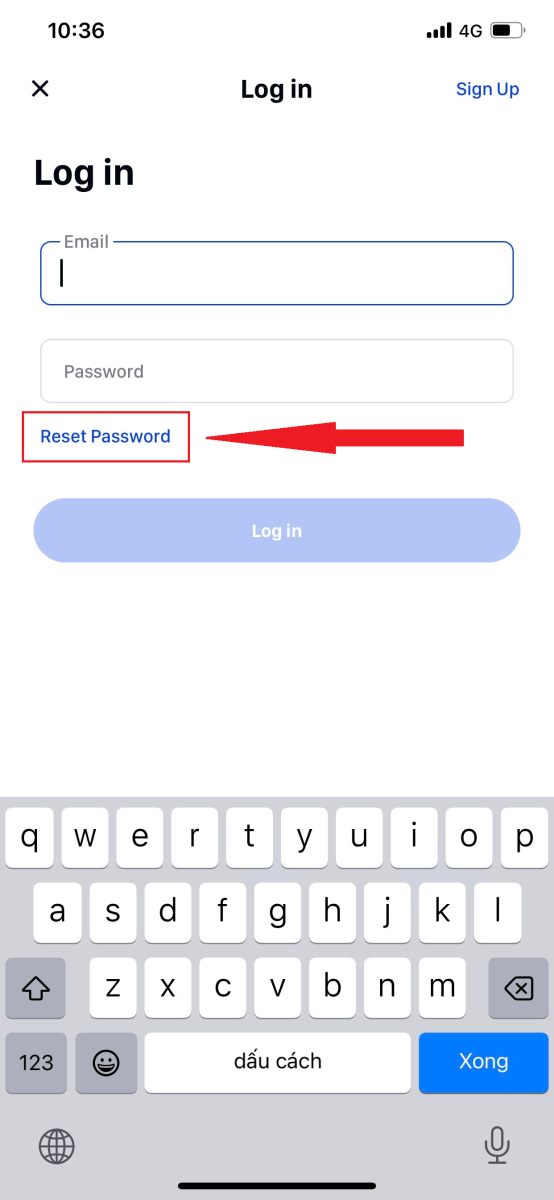

1. Go to the Phemex app and click [Log in].

2. On the login page, click [Reset Password].

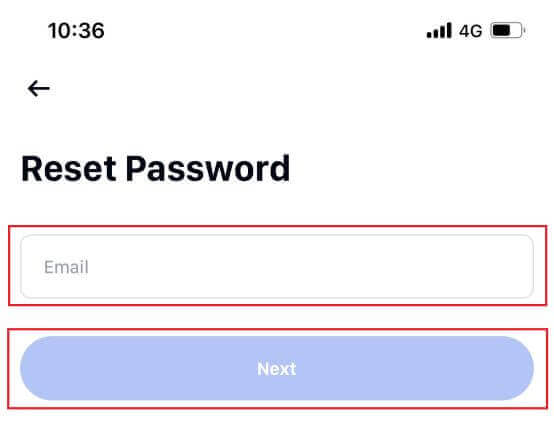

3. Enter your Email and click [Next].

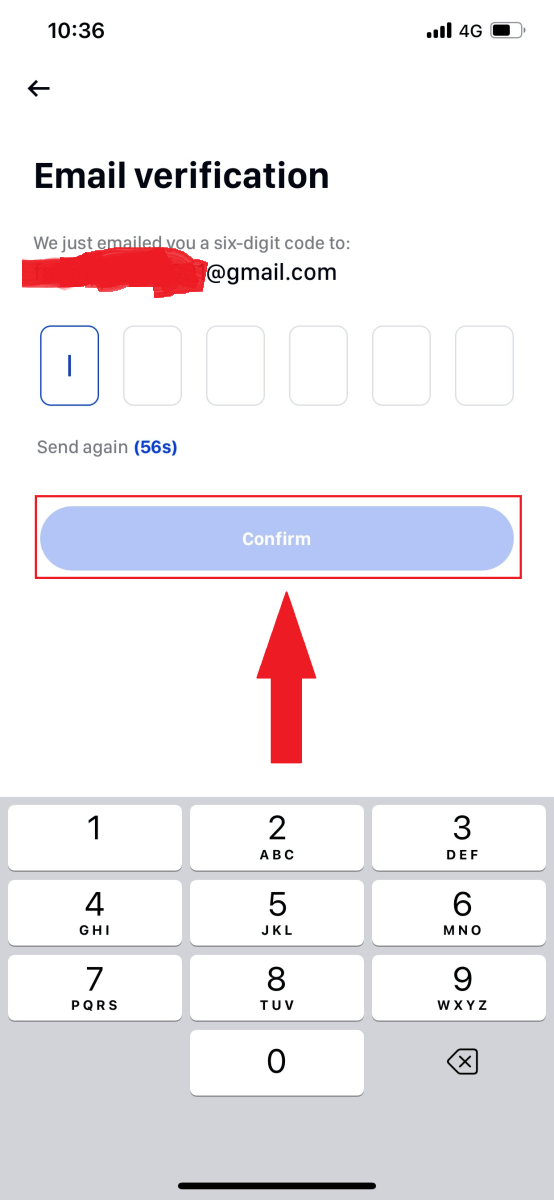

4. Enter the verification code you received in your email, and click [Confirm] to continue.

5. Enter your new password and click [Confirm].

6. Your password has been reset successfully. Please use the new password to log in to your account.

Note: When using the website, follow the same steps as with the app.

Frequently Asked Questions (FAQ)

What is Two-Factor Authentication?

Two-Factor Authentication (2FA) is an additional security layer to email verification and your account password. With 2FA enabled, you will have to provide the 2FA code when performing certain actions on the Phemex NFT platform.

How does TOTP work?

Phemex NFT uses a Time-based One-time Password (TOTP) for Two-Factor Authentication, which involves generating a temporary, unique one-time 6-digit code that is only valid for 30 seconds. You will need to enter this code to perform actions that affect your assets or personal information on the platform.

Please keep in mind that the code should consist of numbers only.

Which actions are secured by 2FA?

After 2FA has been enabled, the following actions performed on the Phemex NFT platform will require users to enter the 2FA code:

- List NFT (2FA can be turned off optionally)

- Accept Bids Offers (2FA can be turned off optionally)

- Enable 2FA

- Request Payout

- Login

- Reset Password

- Withdraw NFT

Please note that withdrawing NFTs requires a mandatory 2FA setup. Upon enabling 2FA, users will face a 24-hour withdrawal lock for all of the NFTs in their accounts.

How to Trade Crypto on Phemex

What is Spot Trading?

What is Spot Trading in Crypto?

Buying cryptocurrencies and holding them until their value rises is known as spot trading in the cryptocurrency market. For example, if a trader purchases Bitcoin, her objective is to sell it later for a profit.This type of trading is not the same as futures or margin trading, which is betting on the fluctuations in cryptocurrency prices. Spot traders truly purchase and sell cryptocurrencies, taking possession of the assets in the process. Spot trading, on the other hand, is distinct from long-term investing or holding onto holdings (HODLing) in that it emphasizes short-term gains through frequent transactions to take advantage of price fluctuations.

Spot trading involves using your own money to purchase assets, so you can only buy what you can afford. Compared to other trading strategies, such as margin trading, where losses may exceed your initial investment, this method is frequently thought to be safer. The worst-case situation in spot trading usually entails losing the entire amount invested with no further obligations.

Spot trading is defined by three essential components: the trade date, the settlement date, and the spot price. The market price at which traders can instantly execute a sale of an asset is known as the spot price. At this price, cryptocurrency can be exchanged for other currencies on a number of exchanges. The spot price is dynamic and changes in response to completed and new orders. While the trade is executed on the trade date, the assets are actually transferred on the settlement date, also known as the spot date.

Depending on the market, there may be a difference in the time between the trade date and the settlement date. In the world of cryptocurrencies, settlements typically take place the same day, though this might vary depending on the exchange or trading platform.

How Spot Trading Works in Crypto?

In the cryptocurrency world, spot trading can be started on a decentralized exchange (DEX) or a centralized exchange (CEX). DEXs use automated market makers (AMMs) and smart contracts, whereas CEXs use an orderbook model. Beginners in cryptocurrency trading typically favor CEXs because they offer an interface that is easier to use.

Spot trading gives you the ability to buy different cryptocurrencies, such as Ethereum (ETH) and Bitcoin (BTC), with fiat money or by transferring between different cryptocurrency pairs. Choose a suitable exchange first. As an example, let’s look at the centralized exchange Luno. Deposit fiat money into your exchange account or move cryptocurrency from another wallet after creating an account. Next, decide which cryptocurrency pair—such as BTC/USDC—you want to trade.

Order types that are available are stop limit, limit, and market orders. For example, after choosing the BTC/USDC pair, you initiate a ’buy’ order and indicate the trade amount. When your buy order and a matching sell order line up in the orderbook, your buy order will be filled. Since market orders are usually filled quickly, trade settlement happens almost instantly.

On the other hand, trade dealers, not software programs, facilitate over-the-counter (OTC) transactions. Thanks to smart contracts, DEXs use blockchain technology to pair buy and sell orders, allowing traders to carry out spot trading strategies right from their wallets. In the current digital era, trading can also take place over the phone, through brokers, and on over-the-counter platforms.

After obtaining your assets, if their value has increased, you can use any of these strategies to sell them for more money and realize your gains.

Pros of Crypto Spot Trading

Buying cryptocurrency at the spot price gives you the unique benefit of actual asset ownership. With this control, traders can decide when to sell their cryptocurrency or move it to offline storage. Possession of the asset also makes it possible to use your cryptocurrency for other uses, such as staking or online payments.Easygoing

Spot trading is distinct due to its ease of use. Complex wallets, platforms, or tools are not necessary. Purchasing the asset at its current market value is a process. This simple method works well when combined with long-term cryptocurrency holding strategies such as HODLing (holding for the expectation of value appreciation) and DCAing (Dollar Cost Averaging). These tactics work especially well for blockchains that have a vibrant community and high usage rates because investing in cryptocurrencies over time can result in substantial profits.

Availability

The accessibility of spot trading is another important advantage. Spot orders are available almost everywhere and can be executed on a variety of platforms, making crypto spot trading extremely accessible to a wide range of users.

Reduced Risk in Comparison with Other Approaches

While there are risks associated with trading in general, spot trading is thought to be less risky than leveraged or futures trading. While futures trading in the speculative cryptocurrency market carries its own set of risks, leverage trading involves borrowing funds, which increases the potential for greater losses. Spot trading, on the other hand, entails just purchasing and selling the asset at the current price; it does not involve margin calls or extra contributions to your account beyond what is already there. Because of this, it’s a safer choice, especially for people who are hesitant to expose themselves to the volatility of cryptocurrency markets.

Cons of Crypto Spot Trading

One of the biggest disadvantages of spot trading in the cryptocurrency space is that it does not provide leverage. Due to this restriction, traders are only able to use their own funds, which limits their potential to increase returns. On the other hand, because of the leverage used, margin trading in cryptocurrencies offers the possibility of larger gains.

Difficulties with Liquidity: In spot markets, liquidity is a major worry, especially in down markets. Smaller altcoins may see a sharp decline in liquidity, making it more difficult for traders to convert their cryptocurrency holdings into fiat money. This circumstance might cause traders to sell their investments at a loss or hold onto them for a longer period of time.

Physical Delivery Requirements: Physical delivery is frequently necessary for commodities traded on the spot market, such as crude oil. This might not always be feasible and can present logistical difficulties.

Fees: When trading cryptocurrencies in particular, there are a number of fees related to spot trading, such as trading fees, withdrawal fees, and network fees. The overall profitability of trading activities may be lowered by these expenses.

Market Volatility: Spot traders are exposed to risk due to the cryptocurrency market’s well-known volatility. Traders must be alert and cautious because sudden and large price fluctuations can result in significant losses.

Is Crypto Spot Trading Profitable and How?

It is possible to make money with cryptocurrency spot trading, but it takes patience and careful strategy planning. Dollar-cost averaging is a popular trading strategy in which investors buy cryptocurrencies at a discount and hold onto them until their value rises, usually timing the sale to coincide with the start of the next bull market. This strategy works especially well in the cryptocurrency market, where there is a lot of price volatility.

But it’s important to remember that spot trading profits only become real when the cryptocurrencies are sold for fiat money or a specific stablecoin. To reduce possible losses, traders must practice rigorous research and efficient risk management.

In contrast to conventional stock markets, wherein companies distribute profits to their shareholders through the purchase of shares, cryptocurrency trading profits are primarily obtained through the appreciation of asset values. Crypto spot trading can be a good place for beginners to start, but it does require a strong grasp of market trends and the capacity to tolerate market volatility. It is important for traders to carefully consider if they are prepared to manage the risks and potential gains associated with this trading strategy.

How to Trade Spot on Phemex (Web)

A spot trade is a straightforward exchange of goods and services at the going rate, also referred to as the spot price, between a buyer and a seller. When the order is filled, the trade happens right away.

With a limit order, users can schedule spot trades to execute when a particular, better spot price is reached. Using our trading page interface, you may execute spot trades on Phemex.

1. Visit our Phemex website and click on [Log In] at the top right of the page to log into your Phemex account.

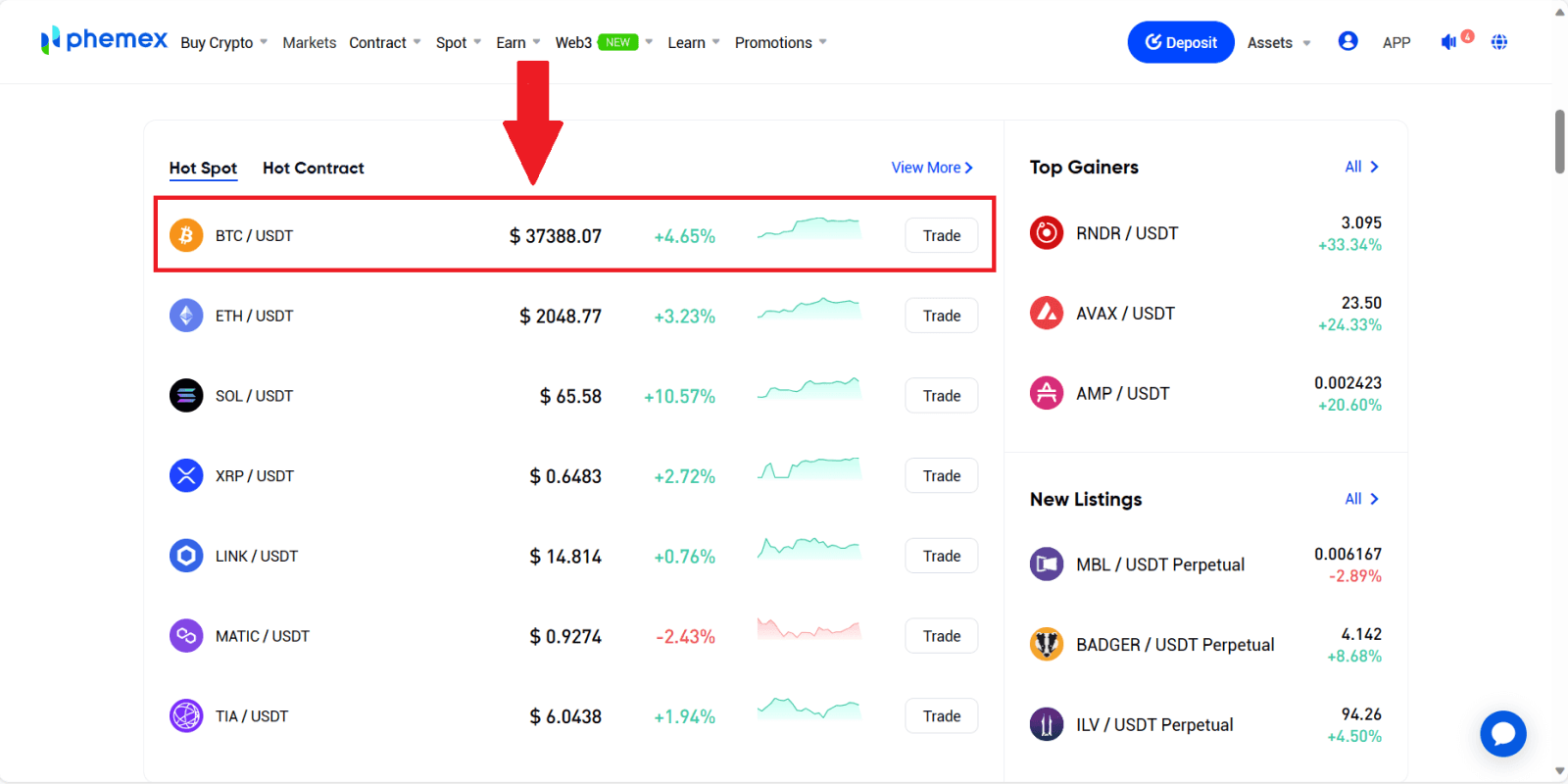

2. To access the spot trading page for any cryptocurrency, simply click on it from the homepage.

You can find a larger selection by clicking [View More] at the top of the list.

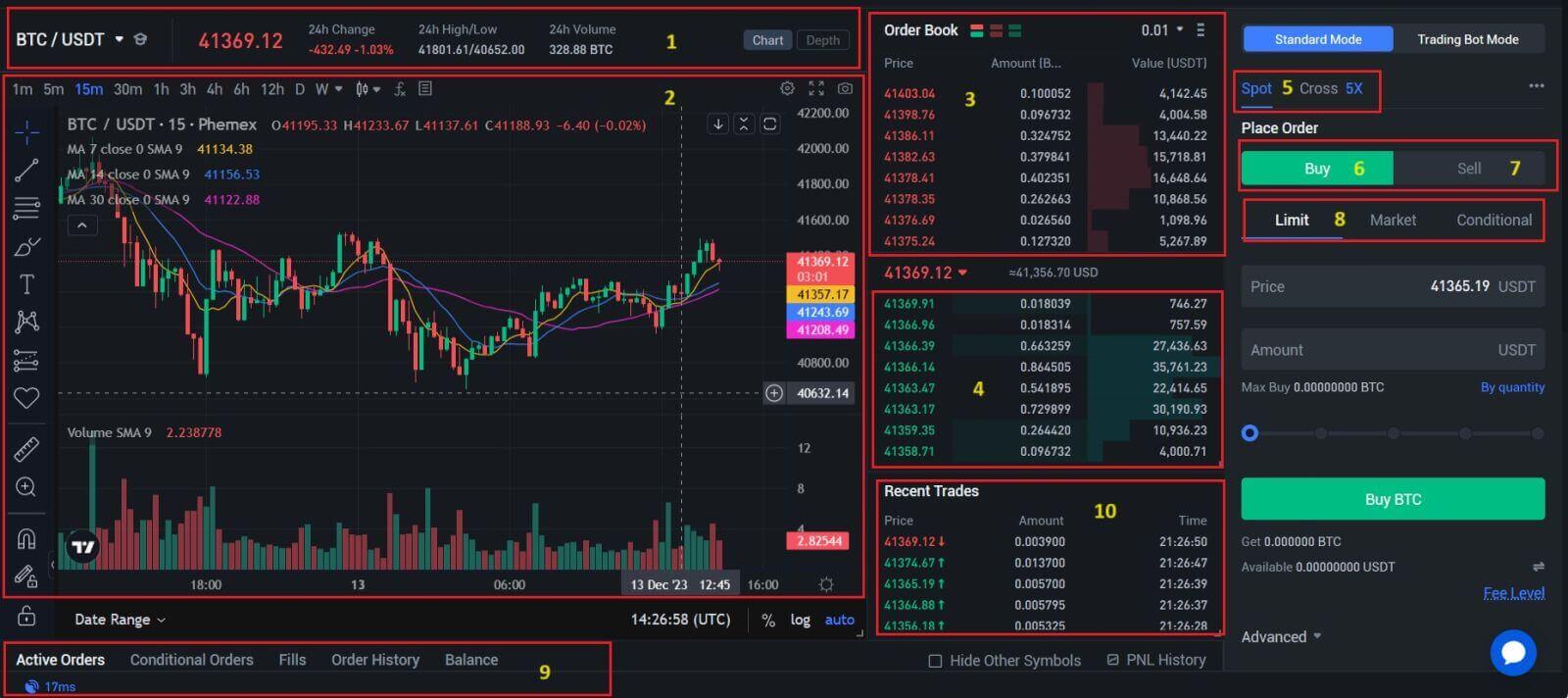

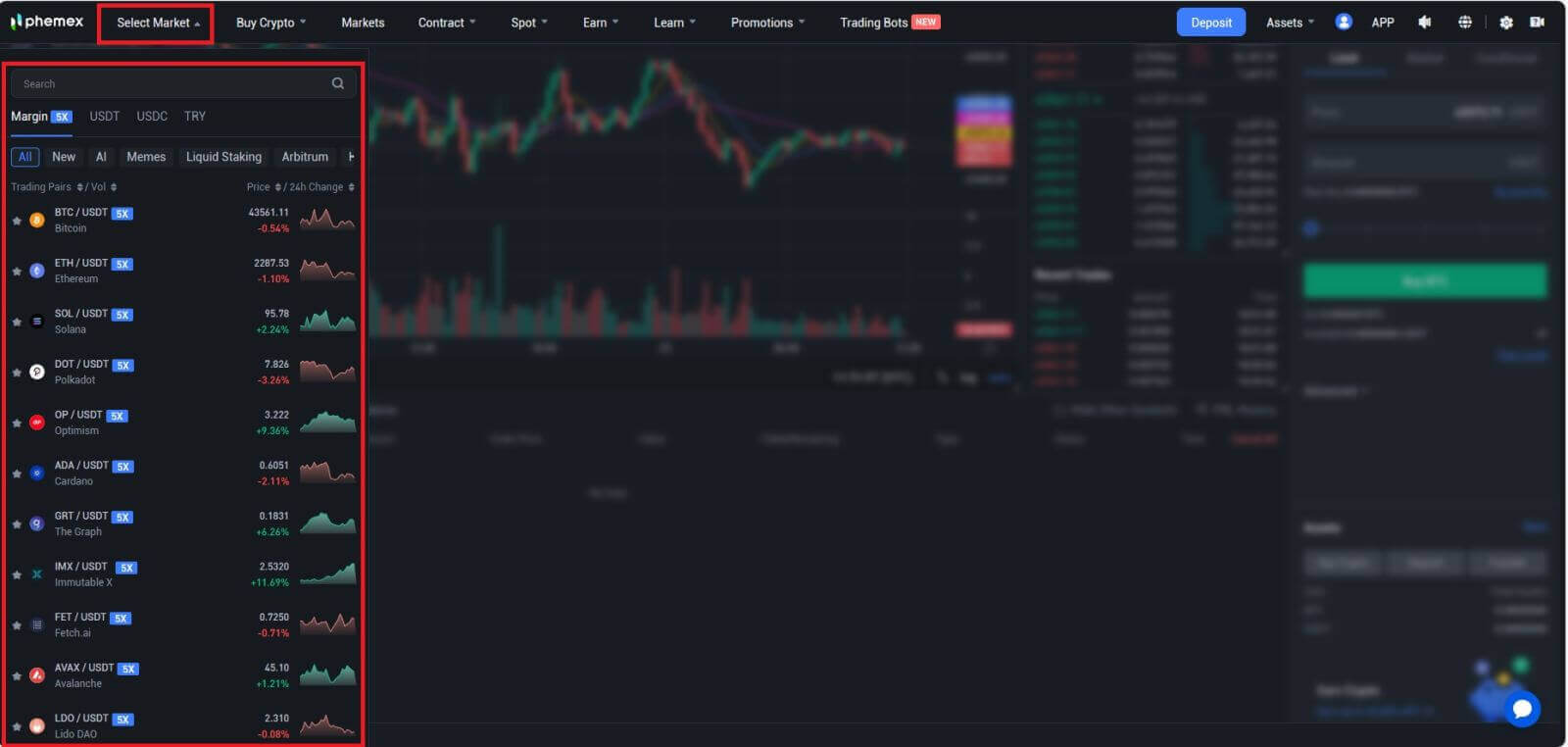

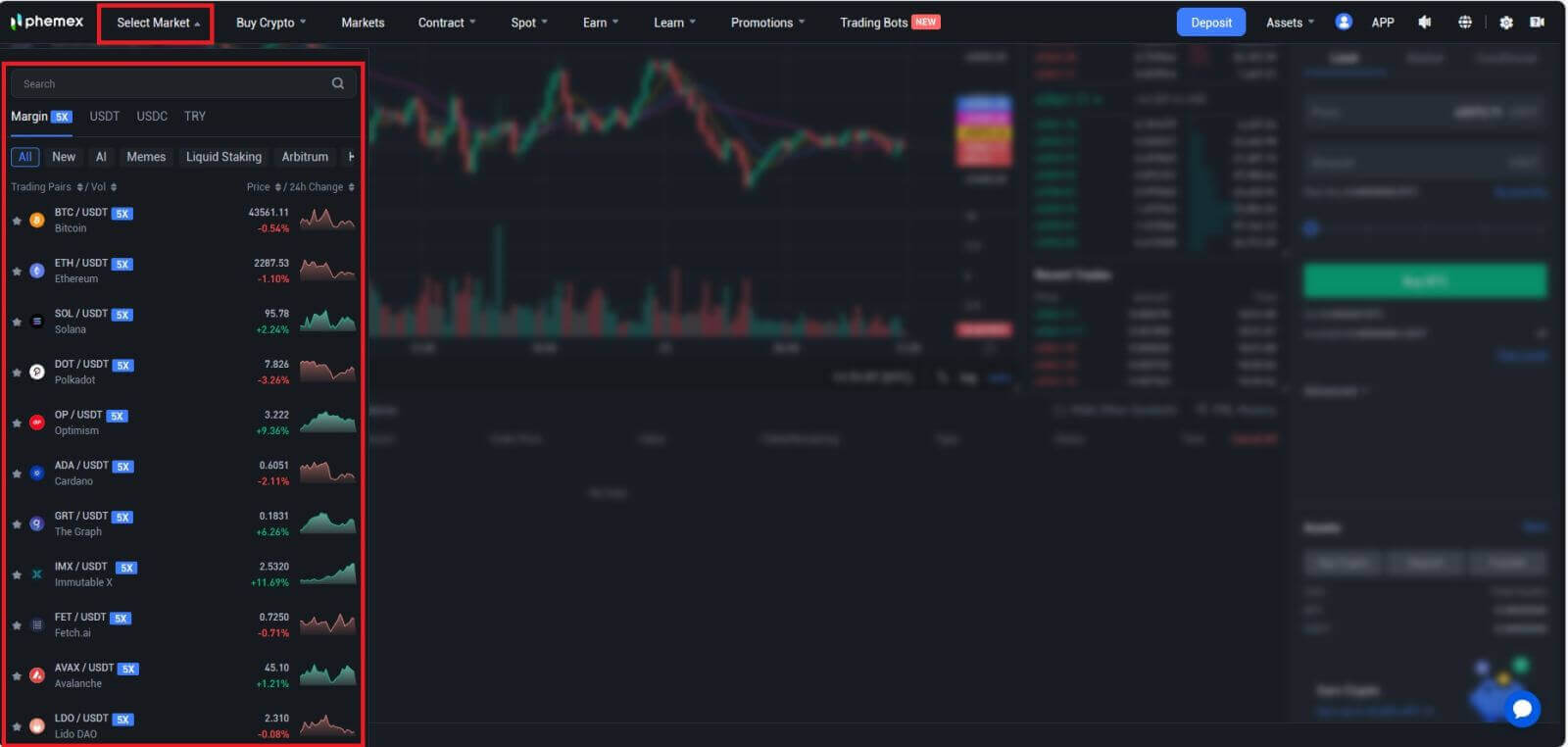

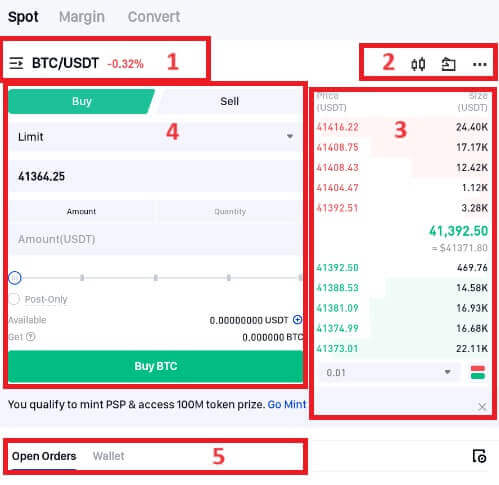

3. At this point, the trading page interface will appear. You will now find yourself on the trading page interface.

- Trading volume of a trading pair in 24 hours.

- Candlestick chart and Market Depth.

- Sell order book.

- Buy order book.

- Trading Type: Spot/Cross5X.

- Buy Cryptocurrency.

- Sell Cryptocurrency.

- Type of order: Limit/Market/Conditional.

- Your Order History, Active Orders, Balances, and Conditional Orders.

- Your latest completed transaction.

How do I Buy or Sell Crypto on the Spot Market? (Web)

Review all of the requirements and adhere to the procedures in order to purchase or sell your first cryptocurrency through the Phemex Spot Market.

Prerequisites: Please read all of the Getting Started and Basic Trading Concepts articles to become familiar with all the terms and concepts used below.

Procedure: The Spot Trading Page offers you three types of orders:

Limit Orders

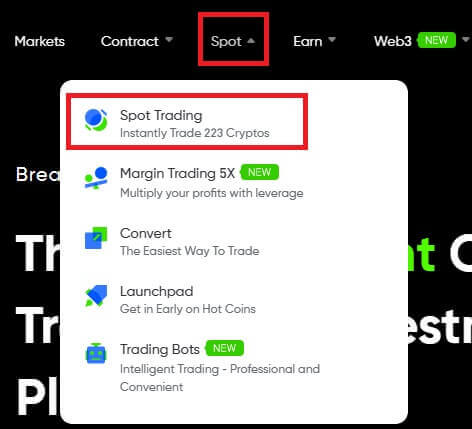

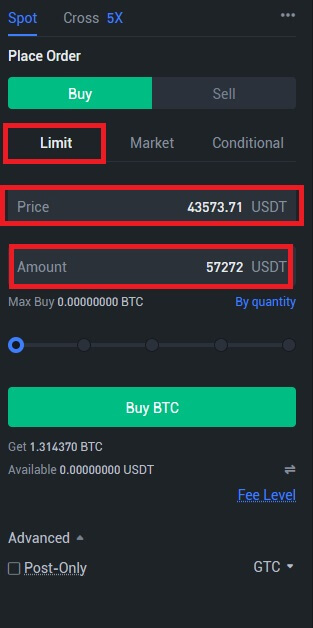

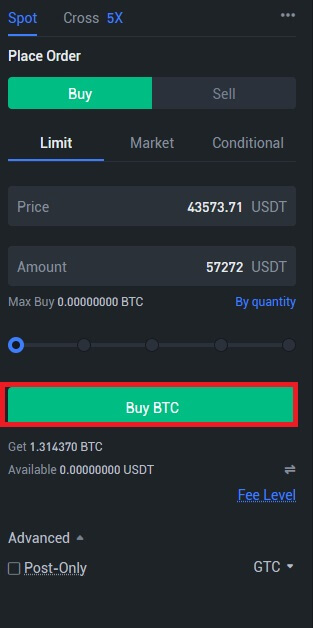

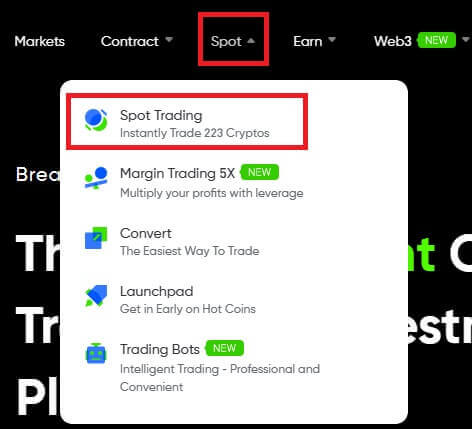

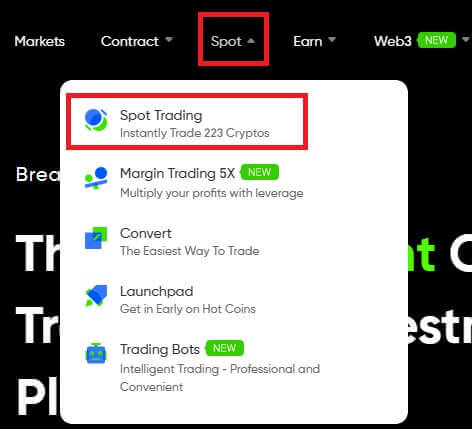

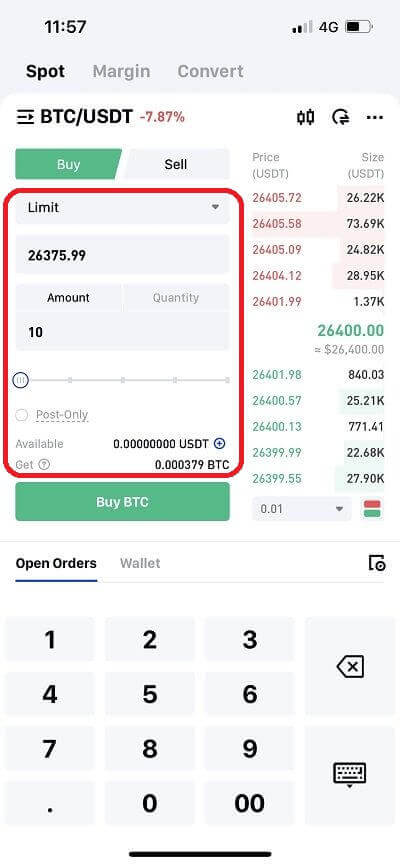

1. Log in to Phemex and click the [Spot]-[Spot Trading] button in the center of the header to navigate to the Spot Trading Page.

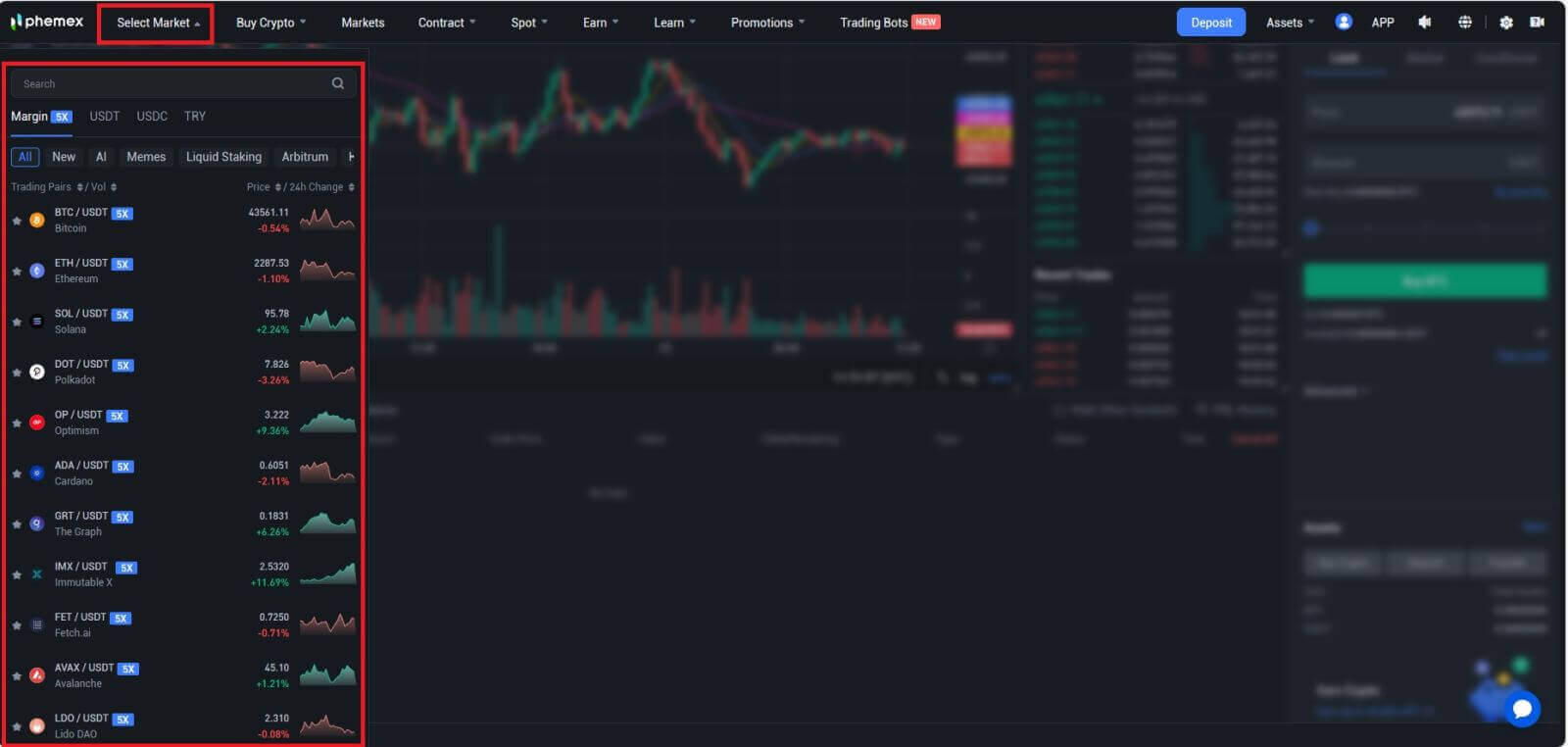

2. Click your desired symbol or coin from Select Market in the top left corner of the page.

3. From the Order Module on the right side of the page, select Limit, set your desired Limit Price. From the drop-down menu below the Limit Price, select either USDT to enter the amount you wish to spend or select your Symbol/Coin to enter the amount you wish to receive.

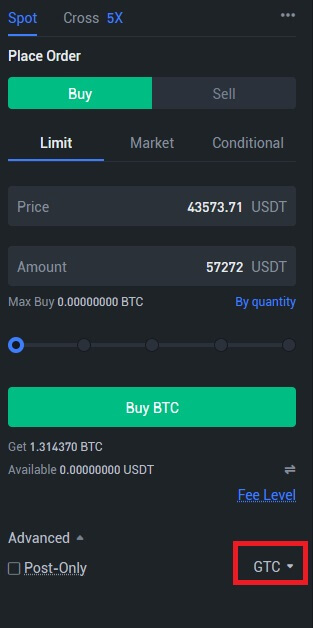

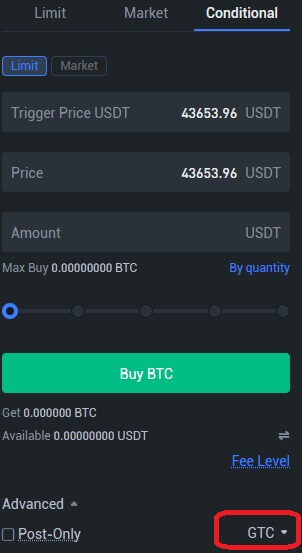

4. At the bottom of the module, select either GoodTillCancel (GTC), ImmediateOrCancel (IOC) , or FillOrKill (FOK) depending on your needs.

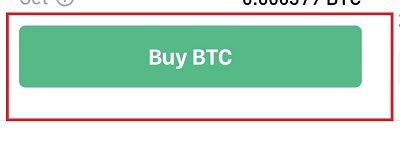

5. Click Buy BTC to display a confirmation window.

6. Click the Confirm button to place your order.

Follow the same procedures as a buy order, but click the Sell button instead of Buy.

NOTE: You can enter the amount to receive in USDT or the amount to spend in your Symbol/Coin.

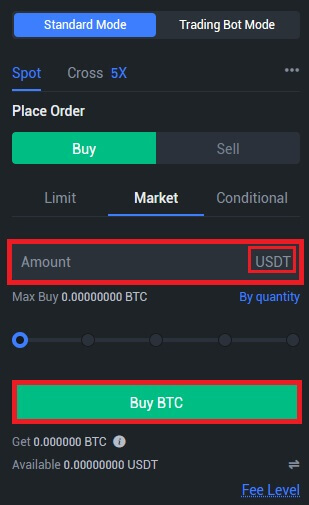

Market Orders

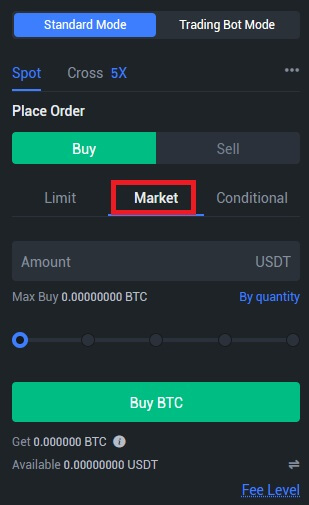

1. Log in to Phemex and click the Spot Trading button in the center of the header to navigate to the Spot Trading Page.

2. Click your desired symbol or coin from Select Market in the top left corner of the page.

3. From the Order Module on the right side of the page, select Market.

4. From the drop-down menu below the Limit Price, select either USDT to enter the amount you wish to spend or select your Symbol/Coin to enter the amount you wish to receive. Click Buy BTC to display a confirmation window.

Click the Confirm button to place your order.

Follow the same procedures as a buy order, but click the Sell button instead of Buy.

NOTE: You can enter the amount to receive in USDT or the amount to spend in your Symbol/Coin.

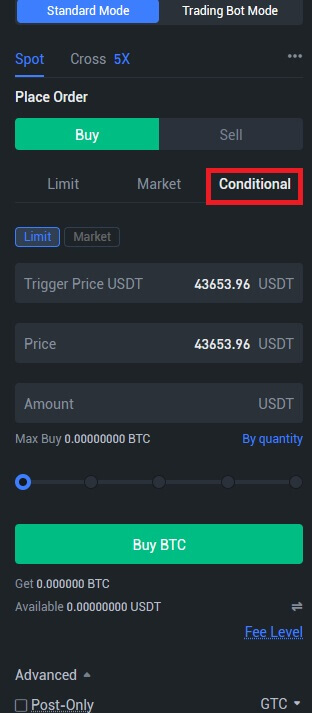

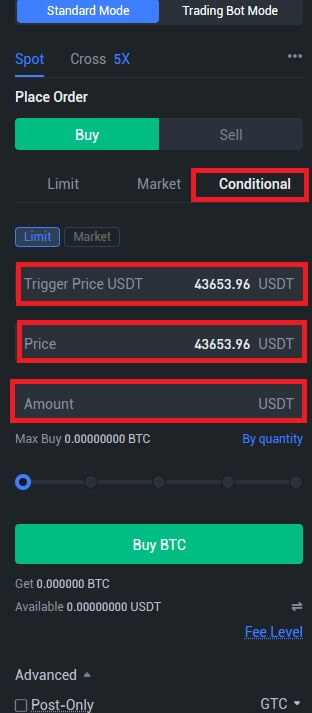

Conditional Orders

1. Log in to Phemex and click the Spot Trading button in the center of the header to navigate to the Spot Trading Page.

2. Click your desired symbol or coin from Select Market in the top left corner of the page.

3. From the Order Module on the left side of the page, select Conditional.

4. Check Limit if you want to set a Limit Price, or Market if you want to use the Market Price at the time that your condition triggers.

If you checked Limit, set your desired Trigger Price USDT and Limit Price. If you checked Market, set your desired Trigger Price and select either USDT to enter the amount you wish to spend or select your Symbol/Coin to enter the amount you wish to receive.

5. If you checked Limit, you also have the option to select either GoodTillCancel, ImmediateOrCancel, or FillOrKill depending on your needs.

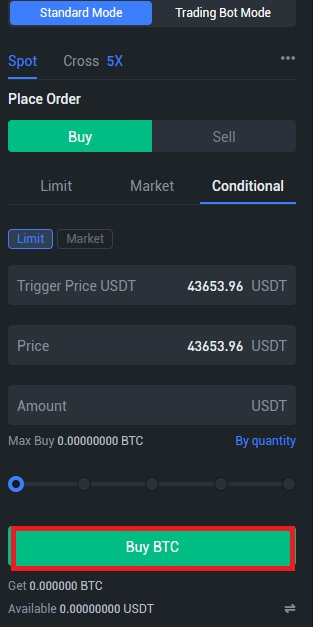

6. Click Buy BTC to display a confirmation window.

Click the Confirm button to place your order.

Follow the same procedures as a buy order, but click the Sell button instead of Buy.

NOTE: You can enter the amount to receive in USDT or the amount to spend in your Symbol/Coin.

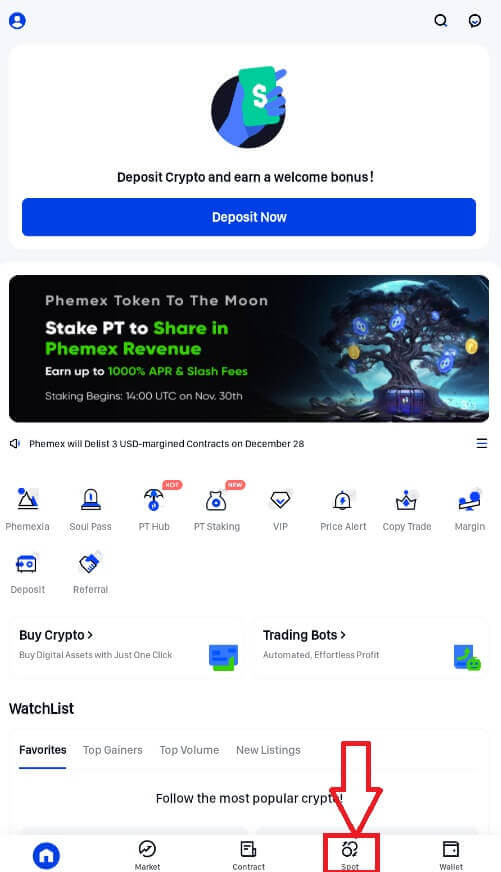

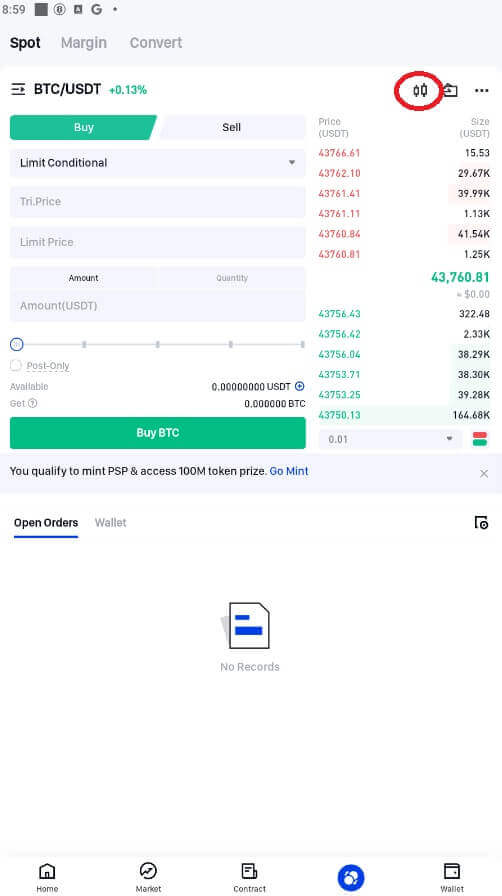

How to Trade Spot on Phemex (App)

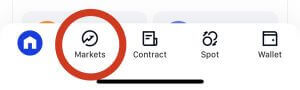

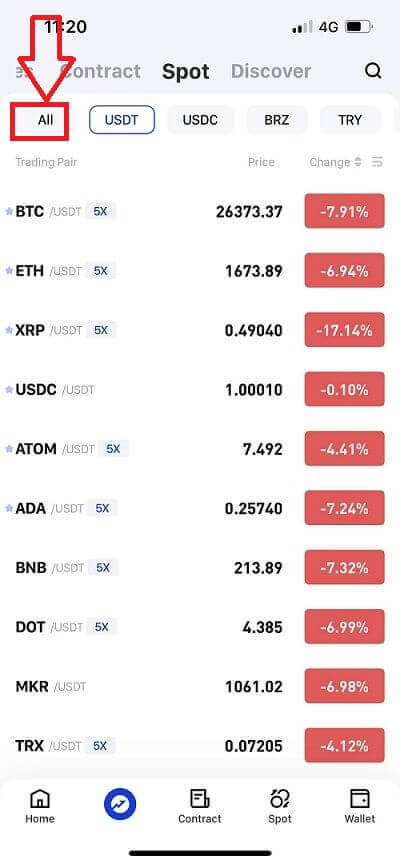

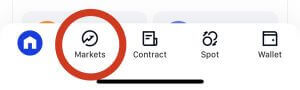

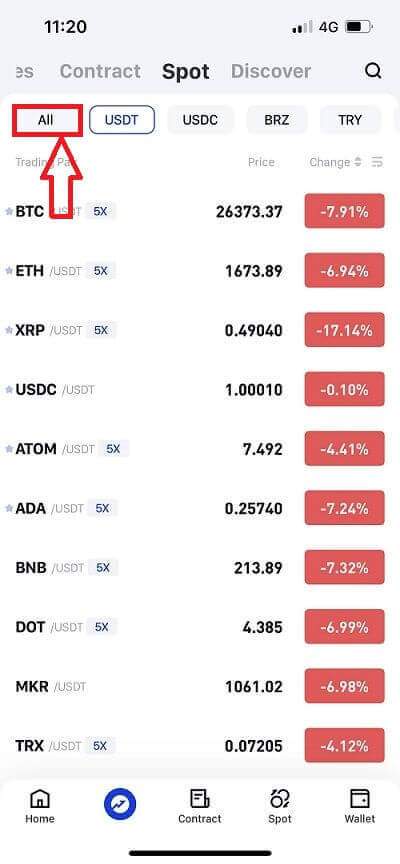

1. Log in to the Phemex App, and click on [Spot] to go to the spot trading page.

2. Here is the trading page interface.

- Market and Trading pairs.

- Real-time market candlestick chart, supported trading pairs of the cryptocurrency, “Buy Crypto” section.

- Sell/Buy order book.

- Buy/Sell Cryptocurrency.

- Open orders.

NOTE:

- The default order type is a limit order. If traders want to place an order as soon as possible, they may switch to [Market Order]. By choosing a market order, users can trade instantly at the current market price.

- If the market price of BNB/USDT is at 0.002, but you want to buy at a specific price, for example, 0.001, you can place a [Limit Order]. When the market price reaches your set price, your placed order will be executed.

- The percentages shown below the BNB [Amount] field refer to the percentage of your held USDT you wish to trade for BNB. Pull the slider across to change the desired amount.

How do I Buy or Sell Crypto on the Spot Market? (App)

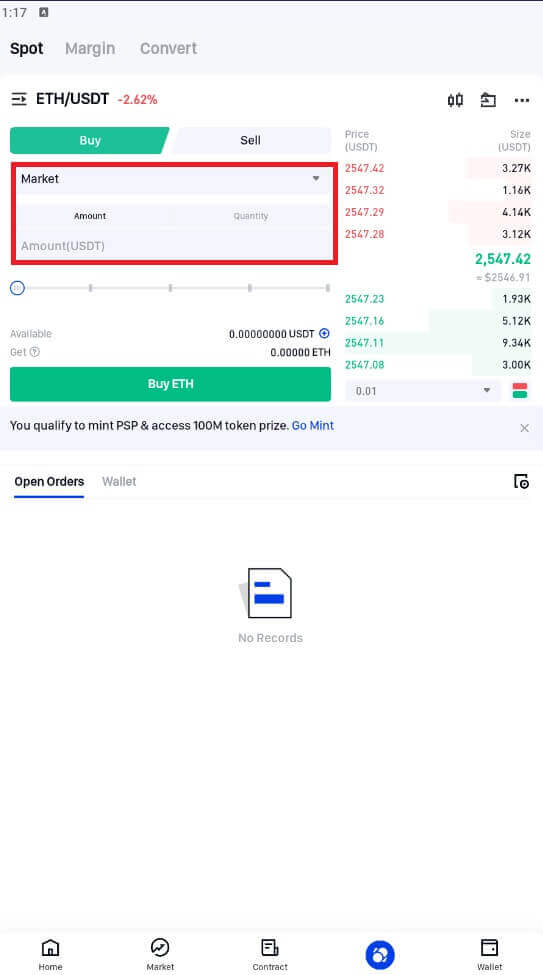

Market Orders

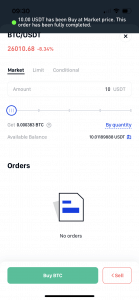

1. Open the Phemex App and log in to your account. Tap the Circular Icon within the bottom navigation bar.

NOTE: If the list is defaulted to Favorites, select the All tab to view all pairs instead

3. Choose the pair that you want to exchange. Click the Buy or Sell button. The Market Order tab will already be selected by default.

4. In the Amount field, enter the target cryptocurrency’s value (in USDT) that you want to order.

NOTE: As you enter an amount in USDT, a counter will display how much of the target crypto you will receive. Alternatively, you can tap the By quantity option. This will allow you to enter the amount of the target crypto you want, while the counter will display how much this costs in USDT.

5. Tap the Buy BTC/Sell button

6. Your order will be immediately executed and filled at the best available market price. You can now see your updated balances on the Assets page.

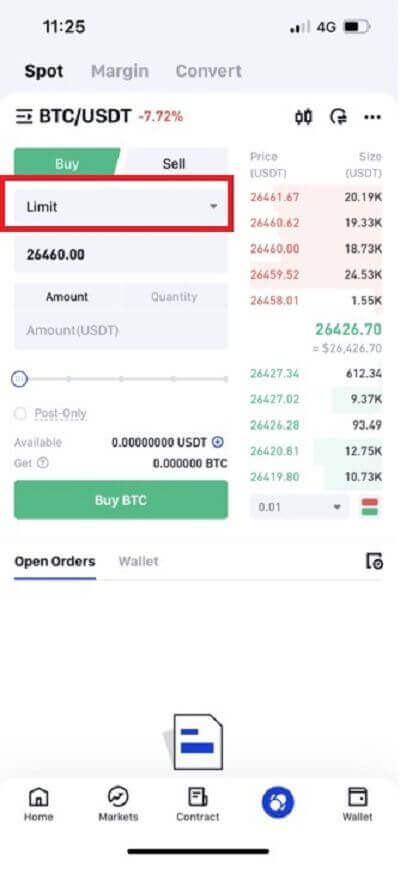

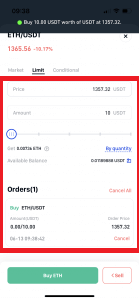

Limit Orders

1. Launch the Phemex App, then sign in with your credentials. Select the Circle Icon located in the lower navigation bar.

2. To view a list of every spot pair, tap the hamburger menu (three horizontal lines) in the upper left corner of the screen. The ETH/USDT pair is the default choice.

NOTE: To view all pairs, select the All tab if the list’s default view is Favorites.

3. Choose the pair that you want to exchange. Either tap the Sell or Buy button. Select the Limit Order tab located in the screen’s center.

4. In the Price field, enter the price you want to use as a limit order trigger.

In the Amount field, enter the target cryptocurrency’s value (in USDT) that you want to order.

NOTE: A counter will show you how much of the target cryptocurrency you will receive as you enter an amount in USDT. As an alternative, you can select by Quantity. You can then enter the desired amount of the target cryptocurrency, and the counter will show you how much it costs in USDT.

5. Press the Buy BTC icon.

6. Until your limit price is reached, your order will be recorded in the order book. The Orders section of the same page displays the order and the amount of it that has been filled.

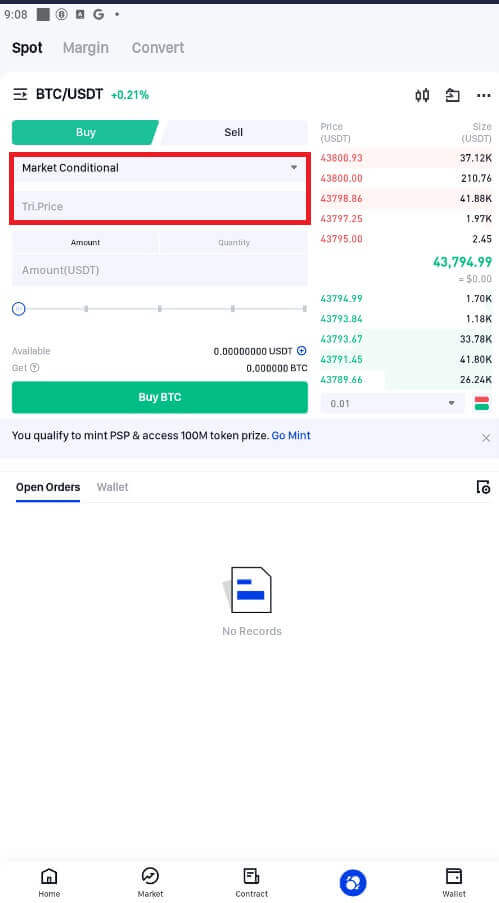

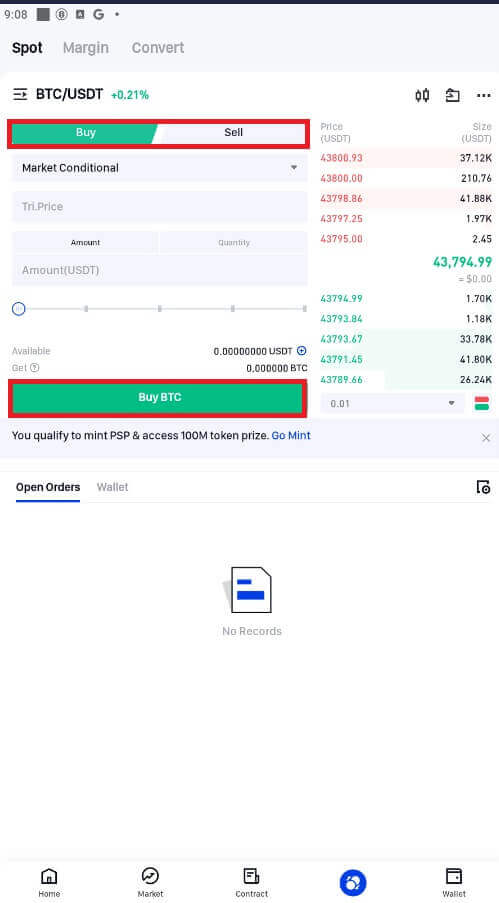

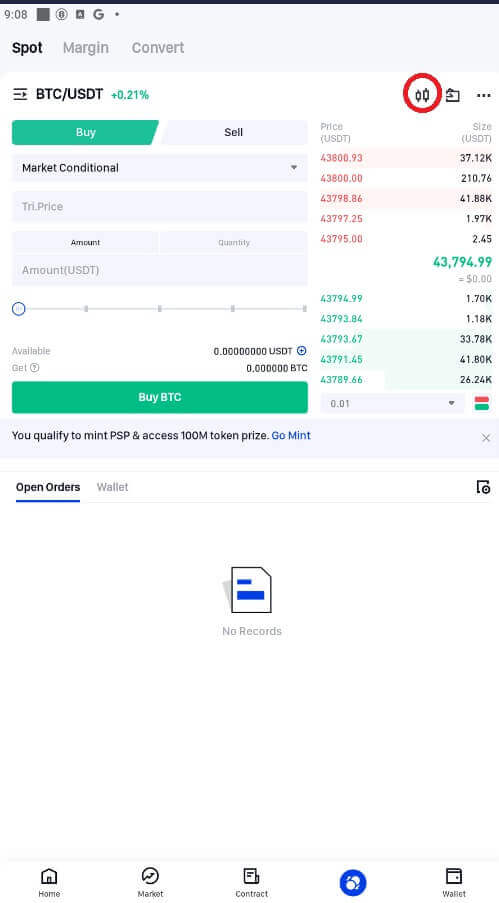

Market Conditional

1. The Market Conditional option is already chosen by default. In the Tri.Price field, enter the trigger price.2. In the Amount field, enter the target cryptocurrency’s value (in USDT) that you want to order.

NOTE: A counter will show you how much of the target cryptocurrency you will receive as you enter an amount in USDT. As an alternative, you can select By quantity. You can then enter the desired amount of the target cryptocurrency, and the counter will show you how much it costs in USDT.

3. Press the Buy/Sell icon. Then choose Buy/Sell BTC.

4. Your order will be instantly executed and filled at the best available market price as soon as the trigger price is reached. On the Assets page, you can now view your updated balances.

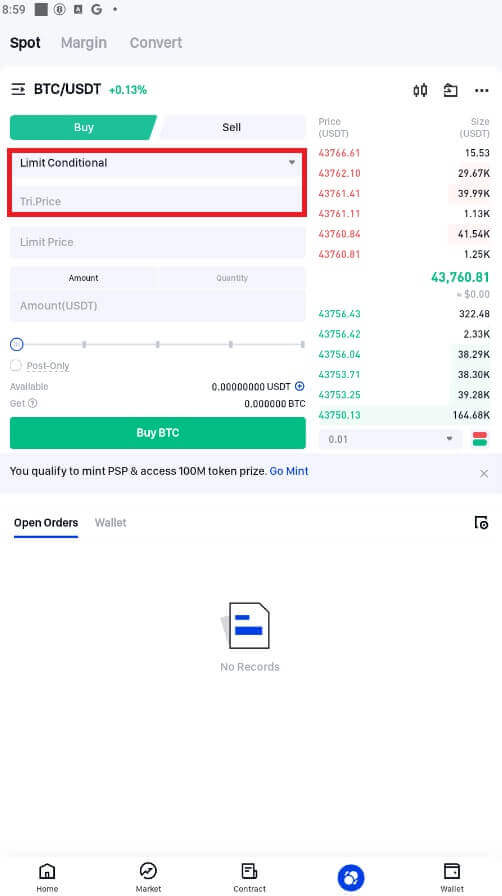

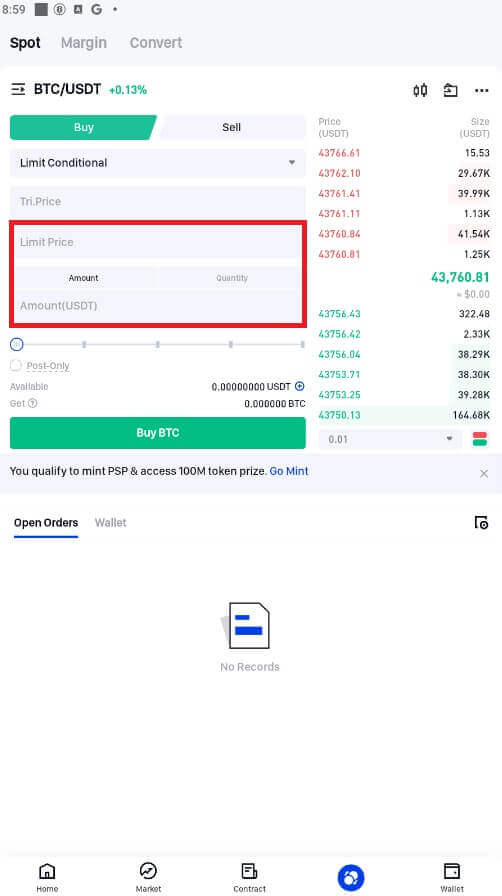

Limit Conditional

1. Choose the Limit Conditional menu item.

2. In the Tri.Price field, enter the trigger price.

3. A limit order will be generated once the trigger price is reached. In the Limit Price field, enter the limit order’s price.

4. In the Amount field, enter the target cryptocurrency’s value (in USDT) that you want to order.

5. Press the Buy/Sell icon. Then click Buy/Sell BTC

6. Your order will be posted to the order book as soon as the trigger price is reached and will remain there until your limit price is reached. The Orders section of the same page displays the order and the amount of it that has filled.

Spot Trading vs Future Trading

Spot Markets

- Immediate Delivery: In spot markets, the transaction involves the immediate purchase and delivery of assets, such as Bitcoin or other cryptocurrencies. This allows traders to gain immediate possession of the asset.

- Long-Term Strategy: Spot market trading is typically aligned with a long-term investment strategy. Traders buy crypto assets when prices are low and aim to sell them when their value increases, usually over an extended period.

Futures Trading

- Not Owning the Underlying Asset: Futures trading in the crypto market is unique in that it does not involve owning the actual asset. Instead, futures contracts represent a commitment to the asset’s future value.

- Agreement on Future Transactions: In futures trading, you enter an agreement to buy or sell the asset, such as Bitcoin or other cryptocurrencies, at a pre-agreed price on a specified future date.

- Shorting and Leverage: This form of trading allows for shorting the market and utilizing leverage. These tools can be particularly advantageous for those looking to make short-term gains in the crypto market.

- Cash Settlement: Typically, futures contracts are settled in cash upon reaching their expiration date, as opposed to actual delivery of the underlying crypto asset.

The Differences Between Spot Trading and Margin Trading

Spot Trading

- Capital Use: In spot trading, traders invest their own funds to acquire assets such as stocks or cryptocurrencies. This approach does not entail the use of borrowed money.

- Profit Dynamics: Earnings in spot trading generally materialize when the value of the asset, be it Bitcoin or another crypto, increases.

- Risk Profile: The risk associated with spot trading is often seen as lower since it involves investing personal capital, with profits dependent on the appreciation of the asset’s price.

- Leverage: Leverage is not a component of spot trading.

Margin Trading

- Borrowing Capital: Margin traders use borrowed funds to buy greater quantities of assets, including stocks and cryptocurrencies, thus enhancing their purchasing power.

- Margin Requirements: To avoid margin calls, traders in margin trading must adhere to specific margin requirements.

- Timeframe and Costs: Margin trading typically involves a shorter operational timeframe due to the costs linked to margin loans.

- Profit Dynamics: In margin trading, profits can be achieved when the crypto market moves in any direction, up or down, providing more versatility compared to spot trading.

- Risk Profile: Margin trading is viewed as more hazardous, with the potential for losses to surpass the initial investment.

- Leverage: This trading style employs leverage, which can lead to significantly higher profits or losses.

Frequently Asked Questions (FAQ)

What is a Limit Order

A limit order is an order that you place on the order book with a specific limit price. It will not be executed immediately, like a market order. Instead, the limit order will only be executed if the market price reaches your limit price (or better). Therefore, you may use limit orders to buy at a lower price or sell at a higher price than the current market price.

For example, you place a buy limit order for 1 BTC at $60,000, and the current BTC price is 50,000. Your limit order will be filled immediately at $50,000, as it is a better price than the one you set ($60,000).

Similarly, if you place a sell limit order for 1 BTC at $40,000 and the current BTC price is $50,000. The order will be filled immediately at $50,000 because it is a better price than $40,000.

| Market Order | Limit Order |

| Purchases an asset at the market price | Purchases an asset at a set price or better |

| Fills immediately | Fills only at the limit order’s price or better |

| Manual | Can be set in advance |

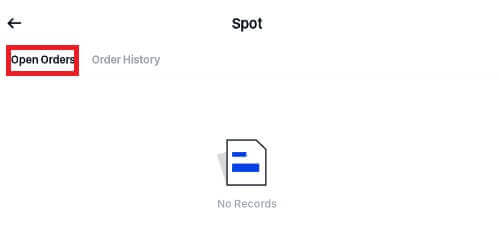

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

1. Open Orders

Under the [Open Orders] tab, you can view the details of your open orders.

2. Order History

Order history displays a record of your filled and unfilled orders over a certain period. You can view the order details, including:

- Symbol

- Type

- Status